Give stock to your supporters

The concept of a company is evolving. Physical offices and 9-to-5s suddenly seem anachronistic. The winning companies of today look more like communities: networks of people who share a common goal.

Everyone who contributes to your company’s mission is a member of your community. But not all community members share in your company’s success.

Founders, investors, and employees capture most of the gains by the time a company exits, while many high-impact supporters are left empty-handed.

Most founders recognize the power of their community and would love to make them shareholders. They just don’t know how.

Lawyer admonitions, investor reservations, and compensation confusion have blocked creative solutions to this problem.

There’s a better way. Give yourself the ultimate network effect by rewarding your community with stock.

Here’s how:

1. Set A Budget & Get Approval

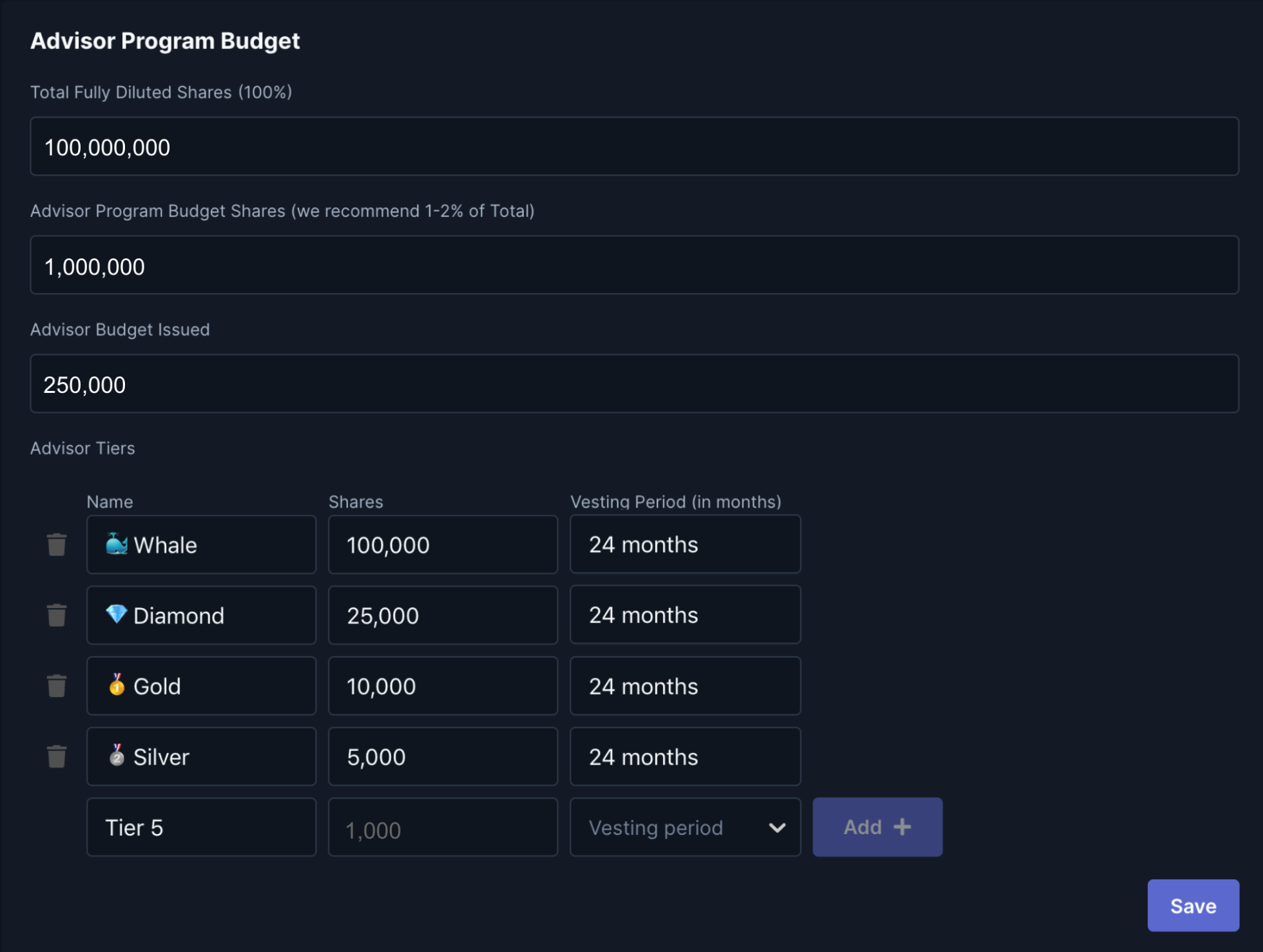

Commit a portion of your option pool to your community. Just 1% of your fully diluted share count can go a long way.

Come up with an estimated number of community shareholders. This might be your 100 most active users, your 500 most loyal followers, or your 50 channel partners. Keep the total below 2,000 to avoid triggering SEC filing requirements.

Create tiers with different amounts of stock based on the expected contribution of the recipient. Use Cabal for this:

Once you’ve set your budget, share the plan with your board for approval. This may not be required based on your governance, but it’s a good practice.

2. Determine Eligibility Requirements

Unlike investors, community members receiving stock options do not need to be accredited. Too many people are excluded from building a portfolio because they can't afford to invest. Community equity gives them a chance to earn their way into a portfolio.

But figuring out who within your community you want to share equity with can be tricky. Our advice is to start small and don’t overthink it.

3. Tell Your Community

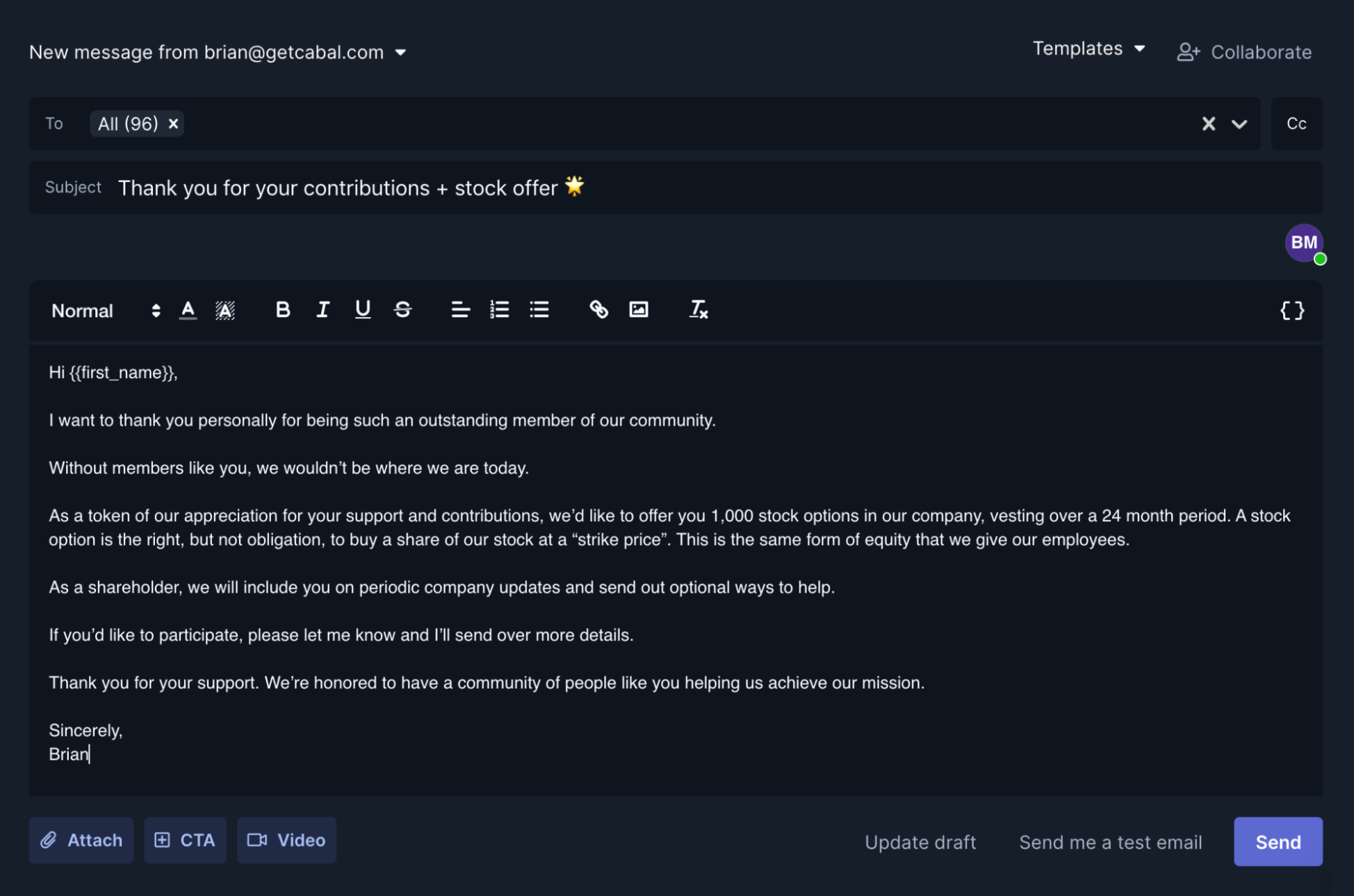

Once you have board approval and you’ve determined eligibility, announce the program.

This is your opportunity to show your commitment and appreciation for the community. If you have expectations for eligible members, articulate those in the announcement.

Use Cabal to deliver the announcement.

4. Start Onboarding

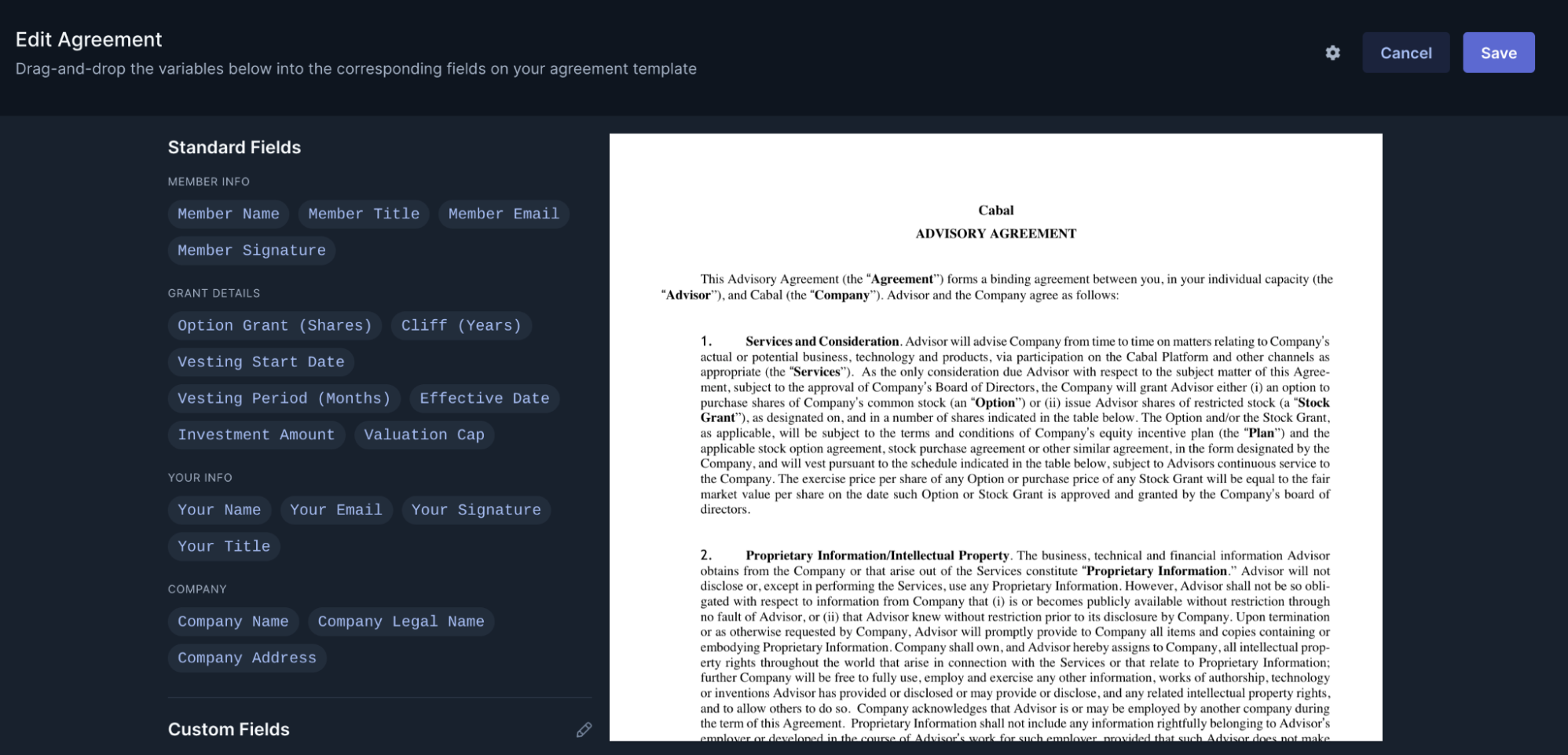

Send participating members an advisor agreement. This agreement formalizes the relationship between the community member and your company so you can issue them options without violating securities law (Rule 701).

Cabal’s built-in Advisor Agreement and Bulk Agreement feature make this process simple.

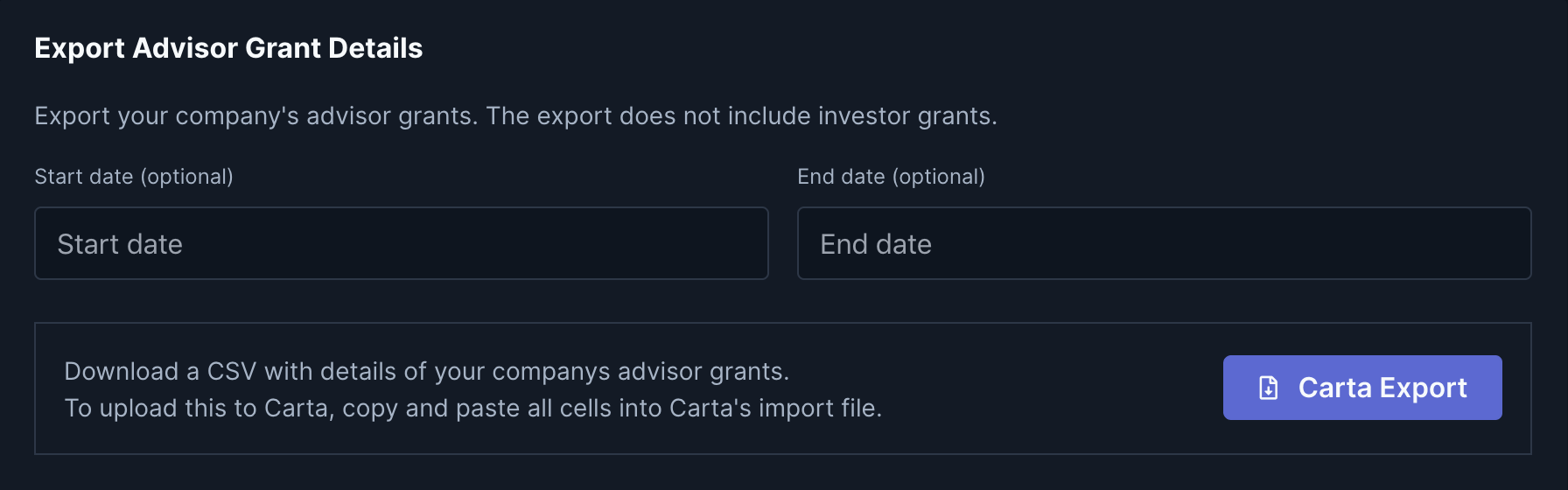

After members have signed their agreements in Cabal, export the advisor grant details from Settings. The export is compatible with your cap table management tool which will handle all vesting and exercise-related notifications.

5. Manage Community Contributions

Congrats—you have just transformed your community into owners! When you win, they win. Make the most out of this new superpower, through regular engagement.

We recommend sending monthly updates (a shorter version of your investor update) along with ad hoc asks and offers.

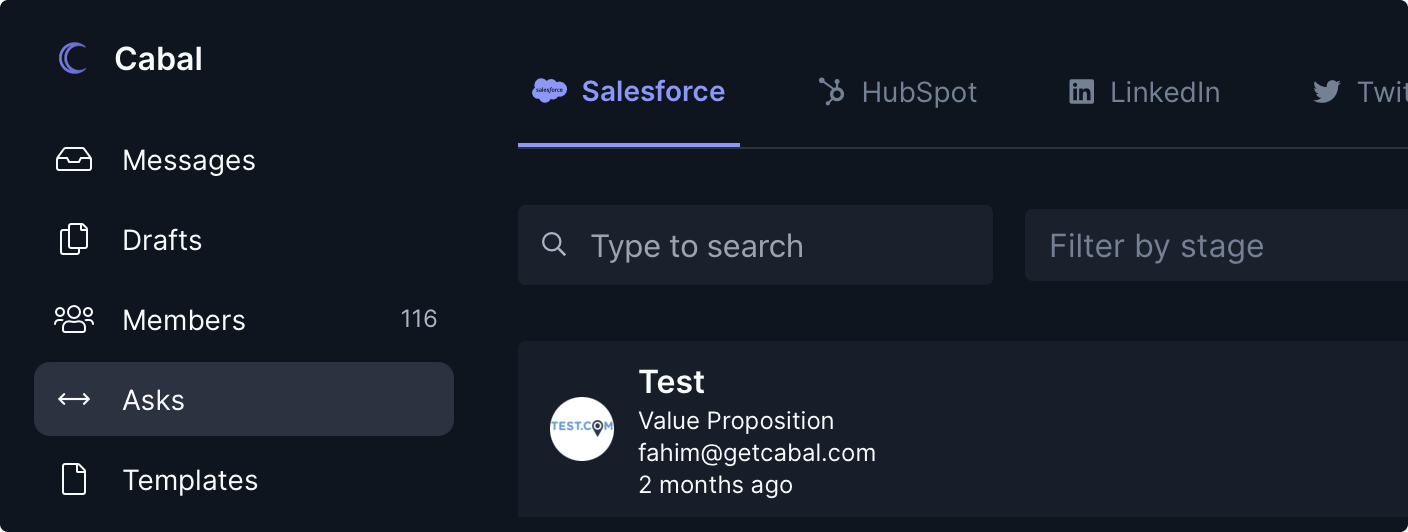

Cabal connects with your business systems like CRM, Job Board, and Social Channels to make contributing easy.

We created Cabal so founders of any stage, industry, or geography can win with their community.

If you’re ready to give stock to your community, we’d love to help.

Visit getcabal.com to sign up for free.